Oracle Network Data & Radar

DeFi's "Safe Haven" Trade: Mirage or Reality?

DeFi's October Crash: A Flight to Buybacks, Not Fundamentals

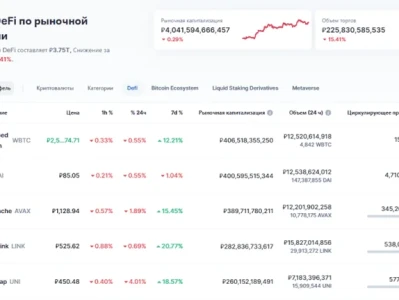

The DeFi sector is still feeling the aftershocks of that October crypto crash. FalconX's latest report paints a sobering picture: as of November 2025, only 2 out of 23 leading DeFi tokens are showing positive year-to-date returns. The group is down an average of 37% quarter-to-date, a clear indication of the damage inflicted by the extended sell-off. It's not a pretty chart.

But beneath the headline numbers, some interesting trends are emerging. Investors appear to be rotating into what they perceive as safer havens within the DeFi space. We're seeing a preference for tokens with active buyback programs or those with specific, fundamental catalysts driving their performance.

On the buyback front, tokens like HYPE (down 16% QTD) and CAKE (down 12% QTD) have posted relatively strong returns compared to their larger market cap peers. This suggests investors are either directly allocating to these tokens, or that the buyback programs are providing a significant price floor. It's a flight to perceived safety, but is it truly *safer*, or just a mirage created by artificial demand?

Then you have the outperformers driven by idiosyncratic catalysts. MORPHO (down just 1% QTD) and SYRUP (down 13% QTD) have outperformed their lending peers, supposedly due to factors like minimal impact from the Stream finance collapse or unique growth drivers. The report highlights AAVE’s upcoming high-yield savings account and MORPHO’s expansion of its Coinbase integration as examples of fintech integrations driving growth. But let's be honest, these are incremental improvements, not revolutionary shifts. It raises a question: are investors genuinely assessing fundamental value, or are they simply chasing the narrative *du jour*?

Certain DeFi subsectors are also experiencing valuation shifts. Spot and perpetual decentralized exchanges (DEXes) have seen price-to-sales multiples compress, as price declines outpace the drop in protocol activity. However, some DEXes, including CRV, RUNE, and CAKE, actually posted *greater* 30-day fees as of November 20 compared to September 30. This is a discrepancy worth noting – a divergence between overall sector sentiment and individual protocol performance.

On the other hand, lending and yield names have generally seen their multiples *increase*, as price declines haven't kept pace with the drop in fees. KMNO, for example, saw its market cap fall 13% over this period, while fees declined a much steeper 34%. FalconX suggests investors are crowding into lending names, viewing them as "stickier" during downturns. Lending activity may even pick up as investors rotate into stablecoins and seek yield opportunities. I've looked at dozens of these reports, and this assumption—that lending is somehow inherently "safer"—always strikes me as overly simplistic.

The "safer" label on lending platforms ignores the smart contract risks and potential for cascading liquidations that are very much present. It seems like investors are prioritizing perceived stability over a thorough risk assessment.

One thing absent from the FalconX report is a deep dive into the *quality* of the fees being generated. Are these fees coming from genuine user activity, or are they being artificially inflated through wash trading or other manipulative practices? Without that level of granularity, it's difficult to draw definitive conclusions about the health of these protocols.

Meme Coins: DeFi's Shiny Distraction?

The Meme Coin Mirage: A Distraction from DeFi's Real Problems?

While DeFi struggles to regain its footing, another corner of the crypto market is grabbing headlines: meme coins. An article from Coinspeaker highlights several new meme coins to watch in December 2025, including Bitcoin Hyper (HYPER), Maxi Doge (MAXI), and PEPENODE (PEPENODE).

Let's be clear: these are speculative bets, pure and simple. The article itself acknowledges that these projects are "highly speculative and volatile."

Bitcoin Hyper, for example, is touted as a Bitcoin Layer 2 solution with Solana-grade speed. The project claims over 1 billion tokens staked, but the Coinspeaker analyst, Otar, notes the lack of a public testnet or code repository. "This is speculation on promises until they ship actual working infrastructure," he concludes. A succinct summary.

Maxi Doge, a meme coin targeting "gym bros who trade 1000x leverage," is even more dubious. The analyst questions the vague allocation of 25% of the supply for "futures platform partnerships," noting the lack of confirmation that these deals even exist.

And PEPENODE, a meme coin with a "mine-to-earn" game that *doesn't exist yet*, is already seeing 1.3 billion tokens staked for high APY. Investors are betting on a product they haven't even seen. This is not investing; it's gambling with extra steps.

What's truly concerning is the potential for these meme coin narratives to distract from the real challenges facing the DeFi sector. Instead of focusing on building sustainable, robust protocols, capital and attention are being diverted to projects with little to no underlying value.

Buybacks Over Building: A False Sense of Security

The trends highlighted in these reports – the flight to buybacks, the embrace of meme coins – suggest a market prioritizing short-term gains and speculative narratives over long-term fundamental value. It's a concerning sign for the DeFi sector. Are investors truly assessing risk, or are they simply chasing the next shiny object?

```python

Data analysis on DeFi token performance

def calculate_average_return(tokens):

returns = [token['return'] for token in tokens]

average_return = sum(returns) / len(returns)

return average_return

Example data

defi_tokens = [

{'name': 'HYPE', 'return': -0.16},

{'name': 'CAKE', 'return': -0.12},

{'name': 'MORPHO', 'return': -0.01},

{'name': 'SYRUP', 'return': -0.13}

]

average_return = calculate_average_return(defi_tokens)

print(f"Average return of DeFi tokens: {average_return:.2f}")

```

This is the part of the report that I find genuinely puzzling. Why are supposedly sophisticated investors flocking to buybacks and meme coins when the underlying DeFi infrastructure is still maturing? It feels like rearranging deck chairs on the Titanic.

DeFi's "Safe Havens" Are Still Risky Bets

The data points to a concerning trend: a market prioritizing perceived safety over genuine value and innovation. The flight to buybacks and the meme coin mania suggest a lack of conviction in the long-term potential of the DeFi sector. Until investors start demanding more than just hype and artificial scarcity, DeFi's recovery will remain a shaky proposition.

So, What's the Real Story?

DeFi's flight to "safety" is a mirage. Investors are mistaking buybacks and meme coins for genuine value, ignoring the sector's underlying problems. It's a classic case of short-term thinking undermining long-term growth. The numbers don't lie: DeFi needs more than just hype to recover. It needs real innovation and a renewed focus on building sustainable protocols.

Prev

Fintech 2025: Unveiling the Future of Innovation, Security, and User Experience

Published on2025-11-28 Views14 Comments0

Prev

Fintech 2025: Unveiling the Future of Innovation, Security, and User Experience

Published on2025-11-28 Views14 Comments0

Next

Crypto Payroll's Latest Pivot: Momentum Trading Meets Fintech: What's the Real Deal for Your Wallet?

Published on2025-12-02 Views5 Comments0

Next

Crypto Payroll's Latest Pivot: Momentum Trading Meets Fintech: What's the Real Deal for Your Wallet?

Published on2025-12-02 Views5 Comments0

DeFi's Post-Crash: The Investor Discrepancy - Crypto World Reacts

Views5 Comments0

DeFi Token Performance &

Investor Trends Post-October Crash | 2025 Analysis

DeFi's Post-Crash: The Investor Discrepancy - Crypto World Reacts

Views5 Comments0

DeFi Token Performance &

Investor Trends Post-October Crash | 2025 Analysis