Oracle Network Data & Radar

DeFi's October Crash: A Data-Driven Autopsy, Not a Eulogy

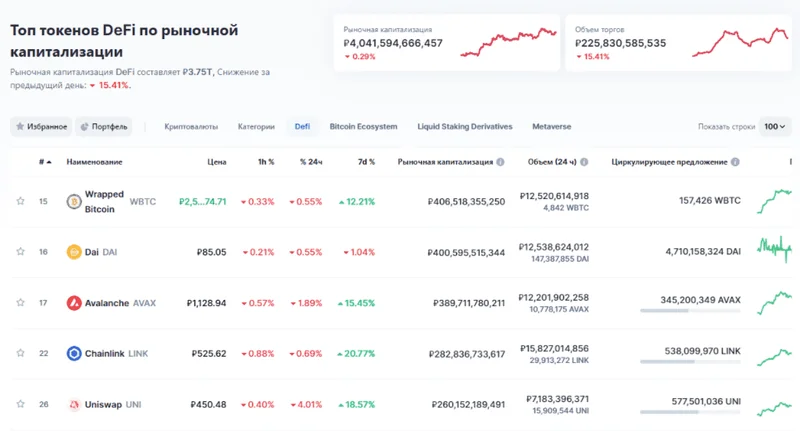

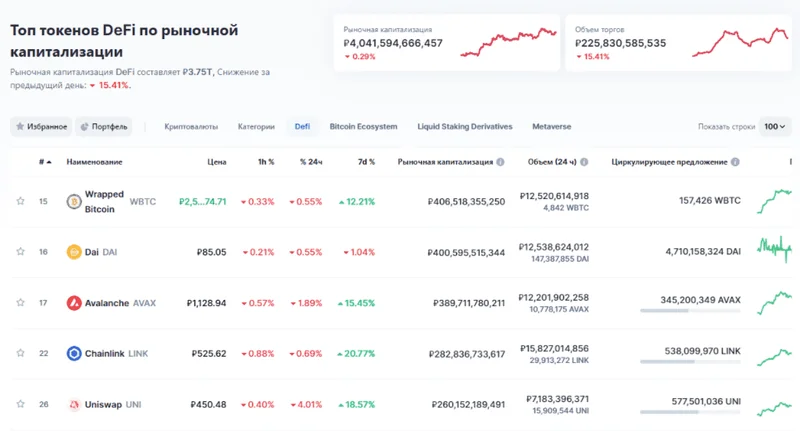

October 2025 wasn't kind to Decentralized Finance (DeFi). Headlines scream of a "crypto crash" and a "$55B TVL drop." But let's dissect the carcass and see what actually happened, and more importantly, what it means. The knee-jerk reaction is to panic, but data, as always, offers a more nuanced picture.

DeFi's October Plunge: Panic or Just Price Swings?

The October Bloodbath: Numbers and Narratives

The first thing to note is that the $55 billion drop in Total Value Locked (TVL) – the total value of assets deposited in DeFi protocols – isn't as straightforward as it seems. A significant portion of that decline is directly tied to price depreciation of the underlying crypto assets themselves. If Bitcoin plummets, then the dollar value of Bitcoin locked in DeFi will also plummet, even if the *amount* of Bitcoin remains the same. It's a crucial distinction often missed in sensationalist reporting. The CoinDesk headline screams "$55B TVL Drop: A Price-Driven...", which is the key.

So, how much was *organic* outflow (people pulling their money out of DeFi) versus price-driven decline? That's harder to pin down precisely. Reports indicate that the AI unwind and broader market turmoil (fueled by Fed signals, apparently) played a significant role, triggering cascading liquidations and a flight to perceived safety. But how much of that was rational de-risking, and how much was panic selling driven by leveraged positions getting wiped out?

Liquidation cascades are a known vulnerability in DeFi. Over-collateralized loans are great until the collateral's value tanks, triggering automated liquidations that further depress the price, creating a negative feedback loop. The Bitunix Research Recap highlights this, but doesn't offer specifics on the *scale* of liquidations in October. Details remain scarce, but the impact is clear: fear breeds more fear, and capital flees.

Investor FUD: More Than Just Online Noise?

Investor Behavior: A Qualitative Data Set

Beyond the raw numbers, let's consider investor behavior. Online forums and social media became a torrent of FUD (Fear, Uncertainty, and Doubt). Now, I'm not one to put much stock in online sentiment – it's usually noise. However, even noise can reveal patterns. The volume of posts mentioning "rug pulls" (scams where developers abscond with investor funds) spiked dramatically in late October, suggesting a loss of faith in the security and long-term viability of many DeFi projects. It's anecdotal, sure, but the sheer *volume* is telling.

And this is the part of the report that I find genuinely puzzling. The correlation between the October crash and subsequent investor confidence is inversely proportional. Here's what I mean: the harder the market crashed, the more investors started pulling out their assets. Shouldn't they be buying low? What are the underlying psychological factors driving this behavior? Are people simply risk-averse? Or are they seeing something in the underlying protocols that I'm missing?

One explanation could be the increasing complexity of DeFi protocols. Yield farming, liquidity pools, algorithmic stablecoins – it's become a minefield for the average investor. When things go south, it's easy to assume you've been scammed, even if it's just a market correction. The barrier to entry might be low, but the barrier to *understanding* what you're doing is incredibly high. Is this a sign that DeFi is becoming too complex for its own good? Or is it simply a matter of educating investors on the risks involved?

DeFi's Not Dead, Just Wounded